Some further quotations… and a short story

The financialization of America was a conscious decision by the oligarchs. They controlled the issuance of credit. They controlled the currency and level of inflation inflicted upon the masses. They controlled the corporations selling consumer goods on credit. They controlled the Congress, courts, and government agencies with their deep pocket lobbying and buying of influence. Lastly, they controlled the media messages and molded the opinions and tastes of the masses through their Bernaysian propaganda techniques perfected over the decades. In one of the boldest and most blatant acts of audacity in world history, the Wall Street/K Street oligarchs wrecked the world economy in their insatiable thirst for profits, shifted their worthless debt onto the backs of taxpayers and unborn generations, threw senior citizens and savers under the bus by stealing $400 billion per year of interest from them, and enriched themselves with bubble level profits and bonus payouts. Meanwhile, median household income continues to fall, real GDP is stagnant, true unemployment exceeds 22%, and 47 million people are living on food stamps.

–Jim Quinn of The Burning Platform blog, Oct 8, 2012, excerpt (brilliant) article, “Decline, decay, denial, delusion, and despair”

The policy of the Status Quo since 2008 boils down to this assumption: if we prop up an artificial economy long enough, it will magically become real.This is an extraordinary assumption: that the process of artifice will result in artifice becoming real. This is the equivalent of a dysfunctional family presenting an artificial facade of happiness to the external world and expecting that fraud to conjure up real happiness. We all know it doesn’t work that way; rather, the dysfunctional family that expends its resources supporting a phoney facade is living a lie that only increases its instability.

–Charles Hugh Smith from Of Two Minds, October 2, 2012, excerpt article, “If You Prop Up An Artificial Economy Long Enough, Does It Become Real?”

There is no nonsense so errant that it cannot be made the creed of the vast majority by adequate governmental action.

–Bertrand Russel

“Capitalism is a vehicle that helped bring the banksters to absolute power, but they have no more loyalty to that system than they have to place, or to anything or anyone…they think on a global scale, with nations and populations as pawns. They define what money is and they issue it, just like the banker in a game of Monopoly. They can also make up a new game with a new kind of money. They have long outgrown any need to rely on any particular system in order to maintain their power. Capitalism was handy in an era of rapid growth. For an era of non-growth, a different game is being prepared.”

–Richard K. Moore, Thunder Road Report, Dec 19, 2011

At a time of universal deceit, telling the truth is a revolutionary act.

–George Orwell

Not ignorance, but ignorance of ignorance, is the death of knowledge

–Alfred North Whitehead

Corruptissima republica, plurimae leges (The more corrupt the state, the more laws)

–Tacitus

“There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

–Ludwig Von Mises

The US has been led down a dark alley and strangled in what history may recognize as a financial coup d’etat, and a campaign of economic war against the common people.

– Jesse, at Cafe Americain

The study of money, above all other fields in economics, is one in which complexity is used to disguise truth or to evade truth, not to reveal it.

–John Kenneth Galbraith

If liberty means anything at all, it means the right to tell people what they do not want to hear

–George Orwell

“Politics is the gentle art of getting votes from the poor and campaign funds from the rich by promising to protect each from the other.”

–Oscar Ameringer

When the people lose faith and don’t know what to believe in, they don’t believe in nothing, they believe in anything.

–Eric Janszen

Some ideas are so stupid only an intellectual can believe them

–George Orwell

Some people say that Americans are ignorant and apathetic. But I don’t know and I don’t care.

–joke, provenance unknown

The hottest places in hell are reserved for those who remain neutral in time of great moral crisis.

–Dante Alighieri

A constant in the history of money is that every remedy is reliably a source of new abuse

–John Kenneth Galbraith

Economic forecasting was invented to make astrology look respectable

–John Kenneth Galbraith

The only time a nation destroys itself is when it becomes efficient in enforcing mediocrity.

– Lyndon Larouche

What will collapse really be like? I expect the event will be spectacular in some ways, but subdued and subversive in many other ways. Triggers may be swift and startling, but the reactions of the populace slow, uncertain, and presumptive. There will be fissures in our foundation, but the complete extent of the danger may take a few more years to become evident. While the public continues to maintain its fixation on some Mad Max nightmare scenario, the real collapse will be taking place right under their noses in the form of 25%-50% increases in food and fuel, tightened job availability with pensions swallowed by austerity, food lines hidden by food stamps until the government finally defaults and pulls the rug out from under entitlement programs, etc. For a time, it will look and feel like a slightly darker version of today, and not the cinematic melodrama that we have come to envision. The worst of times that we often find extolled in the pages of history books come at the cost of years of almost equal disparity, and usually, the lead up is far more difficult to handle than the finale…

–Brandon Smith from Alt-Market, August 6, 2012, excerpt article, “Has the perfect moment to kill the dollar arrived?”

And a short, short story:

It is the month of August, on the shores of the Black Sea. It is raining, and the little town looks totally deserted.

It is tough times, everybody is in debt, and everybody lives on credit.

Suddenly, a rich tourist comes to town.

He enters the only hotel, lays a 100 Euro note on the reception counter, and goes to inspect the rooms upstairs in order to pick one.

The hotel proprietor takes the 100 Euro note and runs to pay his debt to the butcher.

The Butcher takes the 100 Euro note, and runs to pay his debt to the pig grower.

The pig grower takes the 100 Euro note, and runs to pay his debt to the supplier of his feed and fuel.

The supplier of feed and fuel takes the 100 Euro note and runs to pay his debt to the town’s prostitute that in these hard times, gave her “services” on credit.

The hooker runs to the hotel, and pays off her debt with the 100 Euro note to the hotel proprietor to pay for the rooms that she rented when she brought her clients there.

The hotel proprietor then lays the 100 Euro note back on the counter so that the rich tourist will not suspect anything.

At that moment, the rich tourist comes down after inspecting the rooms, and takes his 100 Euro note, after saying that he did not like any of the rooms, and leaves town.

No one earned anything. However, the whole town is now without debt, and looks to the future with a lot of optimism.

And that, ladies and gentlemen, is how the governments of the world are doing business today.

–Source unknown

War – Some observations

“Preventive war was an invention of Hitler. Frankly, I would not even listen to anyone seriously that came and talked about such a thing.”

– Dwight D. Eisenhower

“We will bankrupt ourselves in the vain search for absolute security.”

– Dwight D. Eisenhower

“How far can you go without destroying from within what you are trying to defend from without?”

–Dwight D. Eisenhower

“Every gun that is made, every warship launched, every rocket fired, signifies in the final sense a theft from those who hunger and are not fed, those who are cold and are not clothed.”

– Dwight D. Eisenhower

“As Americans mindlessly celebrate another Memorial Day with cookouts, beer and burgers, the U.S. war machine keeps churning. As we brutally enforce our will on foreign countries, we create more people that hate us. They don’t hate us for our freedom. They hate us because we have invaded and occupied their countries. They hate us because we kill innocent people with predator drones. They hate us for our hypocrisy regarding democracy and freedom. Just when we had the opportunity to make a sensible decision by leaving Iraq and exiting the Middle East quagmire, Obama made the abysmal choice to casually sacrifice more troops in the Afghan shithole. We have thrown over $1.3 trillion down Middle East rat holes over the last 11 years with no discernible benefit to the citizens of the United States. George Bush and Barack Obama did this to prove they were true statesmen. The Soviet Union killed over 1 million Afghans, while driving another 5 million out of the country and retreated as a bankrupted and defeated shell after ten years. Young Americans continue to die, for whom and for what? Our foreign policy during the last eleven years can be summed up in one military term, SNAFU – Situation Normal All Fucked Up. These endless foreign interventions under the guise of a War on Terror are a smoke screen for what is really going on in this country. When a government has unsolvable domestic problems, they try to distract the wilfully ignorant masses by proactively creating foreign conflicts based upon false pretences.”

– Jim Quinn, The Burning Platform, May 27, 2012, excerpt article, “War Pigs – The Fall of a Global Empire”

“I am concerned for the security of our great Nation; not so much because of any threat from without, but because of the insidious forces working from within.”

– General Douglas MacArthur

“What kind of a civilized society allocates 44% of the taxes taken from its people to war? Only 2.5% of your taxes go to science, energy, and environment. Only 2.2% of your taxes go to education and jobs. You produce the results that you would expect from your investments. A full 13% of our population doesn’t have a high school diploma (20% of African Americans and 43% of Latinos) and only 30% have a college degree. How do we expect to lead the world in technology and research with these figures? But we do lead the world in government issued student loan debt with $1 trillion and rising.”

– Jim Quinn, The Burning Platform, May 27, 2012, excerpt article, “War Pigs – The Fall of a Global Empire”

“The military don’t start wars. Politicians start wars.”

– General William Westmoreland

“I hate war as only a soldier who has lived it can, only as one who has seen its brutality, its futility, its stupidity.”

– Dwight D. Eisenhower

“My first wish is to see this plague of mankind, war, banished from the earth.”

– George Washington

“The world has achieved brilliance without wisdom, power without conscience. Ours is a world of nuclear giants and ethical infants. We know more about war than we know about peace, more about killing than we know about living.”

– General Omar Bradley

“He who joyfully marches to music in rank and file has already earned my contempt. He has been given a large brain by mistake, since for him the spinal cord would suffice.”

– Albert Einstein

The third president (1743 – 1826) of the United States, a man who towered above all

“I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

–Thomas Jefferson

“A private central bank issuing the public currency is a greater menace to the liberty of the people than a standing army.”

–Thomas Jefferson

“I do not take a single newspaper, nor read one a month, and I feel myself infinitely the happier for it.”

–Thomas Jefferson

“The man who reads nothing at all is better educated than the man who reads nothing but newspapers.”

–Thomas Jefferson

“Paper is poverty, it is only the ghost of money, and not money itself.”

–Thomas Jefferson

“The spirit of resistance to government is so valuable on certain occasions, that I wish it always to be kept alive.”

–Thomas Jefferson

“The will of the people is the only legitimate foundation of any government, and to protect its free expression should be our first object.”

–Thomas Jefferson

“It is incumbent on every generation to pay its own debts as it goes. A principle which if acted on would save one-half the wars of the world.”

–Thomas Jefferson

“A democracy is nothing more than mob rule, where fifty-one percent of the people may take away the rights of the other forty-nine.”

–Thomas Jefferson

“I have the consolation of having added nothing to my private fortune during my public service, and of retiring with hands clean as they are empty.”

–Thomas Jefferson, letter to Count Diodati, 1807

“No government ought to be without censors and where the press is free, no government ever will.”

–Thomas Jefferson, letter to George Washington, September 9, 1792

“An honest man can feel no pleasure in the exercise of power over his fellow citizens.”

–Thomas Jefferson, letter to John Melish, January 13, 1813

“Some men look at constitutions with sanctimonious reverence, and deem them like the ark of the covenant, too sacred to be touched.”

–Thomas Jefferson, Resolutions, 1803

“Experience has shown that even under the best forms of government those entrusted with power have, in time, and by slow operations, perverted it into tyranny.”

– Thomas Jefferson

” I would rather be exposed to the inconveniences attending too much liberty than to those attending too small a degree of it.”

–Thomas Jefferson, to Archibald Stuart, 1791

“No nation is permitted to live in ignorance with impunity.”

–Thomas Jefferson

Malo periculosam libertatem quam quietam servitutem. (“I prefer the tumult of liberty to the quiet of servitude”)

–Thomas Jefferson to James Madison, 30 January 1787.

Self-Interest and the Pathology of Power: The Corruption of America, Part 2

Posted February 9, 2012

Until very recently I reckoned this Upper Caste of loyal servants comprised about 20% of the American populace, but upon closer examination of various levels of wealth and analysis of advert targeting (adverts only target those with enough money/credit to buy the goods being offered), I now identify the Upper Caste as only the top 10% (the aristocracy is at most the top 1/10th of 1%). Wealth and income both fall rather precipitously below the top 10% line, and as globalization and other systemic forces relentlessly press productivity into fewer hands, then the rewards aggregate into a smaller circle of laborers.

As noted yesterday in Social Fractals and the Corruption of America (Of Two Minds, February 8, 2012), you cannot aggregate healthy, thrifty, honest, caring and responsible people into a group that is dysfunctional, spendthrift, venal and dishonest unless those individuals have themselves become dysfunctional, spendthrift, venal and dishonest.

Since non-pathological people will quit or be fired, then these fractals of corruption are self-selecting and self-perpetuating. This is true not just of financial America but of elected officialdom. Anyone who is still naive or delusional enough to think that getting elected to Congress or the state legislature will empower “doing good” will soon learn the ropes: the next election is less than two years away, and if you want to retain your grip on power you’re going to need a couple million dollars.

So much for “working within the system.” By the time all the donors, lobbyists, leeches and parasites have been properly serviced, the “reform” bill is 2,000 pages long. As a result of the feudal structure of wealth and power in America and the self-reinforcing, self-propagating fractals of pathological servitude, the citizenry are increasingly remote from power. The aristocracy, like feudal lords in distant, fortified castles, demands obedient service of the powerless citizenry: work hard, pay your taxes and service your debt – and fears any awakening of true self-interest.

Just because a devoted member of the Upper Caste is allowed to enter the castle to do his work doesn’t mean he is part of the aristocracy. That glow of proximity to power is his reward for dutifully slaving away as a higher-order serf.

The Loan: An exchange of wealth for income

by Keith Warner

Posted Jan 25, 2012

AS THE TITLE OF THIS ESSAY SUGGESTS, A LOAN IS AN EXCHANGE OF WEALTH FOR INCOME. Like everything else in a free market (imagine happier days of yore), it is a voluntary trade. Contrary to the endemic language of victimization, both parties regard themselves as gaining thereby, or else they would not enter into the transaction.

In a loan, one party is the borrower and the other is the lender. Mechanically, it is very simple. The lender gives the borrower money and the borrower agrees to pay interest on the outstanding balance and to repay the principle. As with many principles in economics, one can shed light on a trade by looking back in history to a time before the trade existed and considering how the trade developed.

It is part of the nature of being a human that one is born unable to work, living on the surplus produced by one’s parents. One grows up and then one can work for a time. And then one becomes old and infirm, living but not able to work. If one wishes not to starve to death in old age, one can have lots of children and hope that they will care for their parents in their old age. Or, one can produce more than one consumes and hoard the difference.

One discovers that certain goods are better for hoarding than others. Beyond a little food for the next winter season, one cannot hoard very much. One of the uses of the monetary commodity is to carry value over time. So one uses a part of one’s weekly income to buy, for example, silver. And over the years, one accumulates a pile of silver. Then, when one is no longer able to work, one can sell the silver a little at a time to buy food, clothing, fuel, etc.

Like direct barter trade, this is inefficient. And there is the risk of outliving one’s hoard. So at some point, a long time ago, they discovered lending. Lending makes possible the concept of saving, as distinct from hoarding. It is as significant a change as when people discovered money and solved the problem of “coincidence of wants”. This is for the same reason: direct exchange is replaced by indirect exchange and thereby made much more efficient.

With this new innovation, one can lend one’s silver hoard in old age and get an income from the interest payments. One can budget to live on the interest, with no risk of running out of money. That is, one can exchange one’s wealth for income.

If there is a lender, there must also be a borrower or there is no trade. Who is the borrower? He is typically someone young, who has an income and an opportunity to grow his income. But the opportunity—for example, to build his own shop—requires capital that he does not have and does not want to spend half his working years accumulating. The trade is therefore mutually beneficial. Neither is “exploiting” the other, and neither is a victim. Both gain from the deal, or else they would not agree to it. The lender needs the income and the borrower needs the wealth. They agree on an interest rate, a term, and an amortization schedule and the deal is consummated.

I want to emphasize that we are still contemplating the world long before the advent of the bank. There is still the problem of “coincidence of wants” with regard to lending; the old man with the hoard must somehow come across the young man with the income and the opportunity. The young man must have a need for an amount equal to what the old man wants to lend (or an amount much smaller so that the old man can lend the remainder to another young man). The old man cannot diversify easily, and therefore his credit risk is unduly concentrated in the one young man’s business. And bid-ask spreads on interest rates are very wide, and thus whichever party needs the other more urgently (typically the borrower) is at a large disadvantage.

Of course the very next innovation that they discovered is that one need not hoard silver one’s whole career and offer to lend it only when one retires. One can lend even while one is working to earn interest and let it compound. This innovation lead to the creation of banks.

But before we get to the bank, I want to drill a little more deeply into the structure of money and credit that develops.

Before the loan, we had only money (i.e. specie). After the loan, we have a more complex structure. The lender has a paper asset; he is the creditor of the young man and his business who must pay him specie in the future. But the lender does not have the money any more. The borrower has the money, but only temporarily. He will typically spend the money. In our example, he will hire the various laborers to clear a plot of land, build a building and he will buy tools and inventory.

What will those laborers and vendors do with the money? Likely they will keep some of it, spend some of it… and lend some of it. That’s right. The proceeds that come from what began as a loan from someone’s hoard have been disbursed into the economy and eventually land in the hands of someone who lends them again! The “same” money is being lent again!

And what will the next borrower do with it? Spend it. And what will those who earn it do? Spend some, keep some, and lend some. Again.

There is an expansion of credit! There is no particular limit to how far it can expand. In fact, it will develop iteratively into the same topology (mathematical structure) as one observes with fractional reserve banking under a proper, unadulterated gold standard!

Without banks, there are two concepts that are not applicable yet. First is “reserve ratio”. Each person is free to lend up to 100% of his money if he wishes, though most people would not do that in most circumstances.

And second is duration mismatch. Since each lender is lending his own money, by definition and by nature he is lending it for precisely as long as he means to. And if he makes a mistake, only he will bear the consequences. If one lends for 10 years duration, and a year later one realizes that one needs the money, one must go to the market to try to find someone who will buy the loan. And then discover the other side of that large bid-ask spread, as one may take a loss doing this.

Now, let’s fast forward to the advent of the investment bank. Like everyone else in the free market, the bank must do something to add value or else it will not find willing trading partners. What does the bank do?

As I hinted above, the bank is the market maker. The market maker narrows the bid-ask spread, which benefits everyone. The bank does this by standardizing loans into bonds, and the bank stands ready to buy or sell such bonds. The bank also aggregates bonds across multiple lenders and across multiple borrowers. This solves the problem of excessive credit risk concentration, coincidence of wants (i.e. size matching), and saves both lenders and borrowers enormous amounts of time. And of course if either needs to get out of a deal when circumstances change, the bank makes a liquid market.

The bank must be careful to protect its own solvency in case of credit risk greater than it assumed. This is the reason for keeping some of its capital in reserve! If the bank lent 100% of its funds, then it would be bankrupt if any loan ever defaulted.

What the bank must not do, what it has no right to do, is lend its depositors’ funds for longer than they expressly intended. If a depositor wants to lend for 5 years, it is not the right of the bank to lend that depositor’s money for ten! The bank has no right to declare, “well, we have a reserve ratio greater than our estimated credit risk and therefore we are safe to borrow short from our depositors to lend long”

Not only has the bank no way to know what reserve ratio will be proof against a run on the bank, but it is inevitable that a run will occur. This is because the depositors think they will be getting their money back, but the bank is concealing the fact that they won’t behind an opaque balance sheet and a large operation. So, sooner or later, depositors need their money for something and the bank cannot honor its obligations. So the bank must sell bonds in quantity. If other banks are in the same situation, the bond market suddenly goes “no bid”.

The bank has no legal right and no moral right to lend a demand deposit or to lend a time deposit for one day longer than its duration. And even then, the bank has no mathematical expectation that it can get away with it forever.

Like every other actor in the market (and more broadly, in civilization) the bank adds enormous value to everyone it transacts with, provided it acts honestly. If a bank chooses to act dishonestly (or there is a central bank that centrally plans money, credit, interest, and discount and forces all banks to play dirty) then it can destroy value rather than creating it.

Unfortunately, in 2012 the world is in this sorry state. It is not the nature of banks or banking per se, it is not the nature of borrowing and lending per se, it is not the nature of fractional reserves per se. It is duration mismatch, central planning, counterfeit credit, buyers of last/only resort, falling interest rates, and a lack of any extinguisher of debt that are the causes of our monetary ills.

2012 – The year of living dangerously

by Jim Quinn

of The Burning Platform

Posted on 8th January 2012

http://www.theburningplatform.com/?p=27063

“In retrospect, the spark might seem as ominous as a financial crash, as ordinary as a national election, or as trivial as a Tea Party. The catalyst will unfold according to a basic Crisis dynamic that underlies all of these scenarios: An initial spark will trigger a chain reaction of unyielding responses and further emergencies. The core elements of these scenarios (debt, civic decay, global disorder) will matter more than the details, which the catalyst will juxtapose and connect in some unknowable way. If foreign societies are also entering a Fourth Turning, this could accelerate the chain reaction. At home and abroad, these events will reflect the tearing of the civic fabric at points of extreme vulnerability – problem areas where America will have neglected, denied, or delayed needed action.” – Strauss & Howe – The Fourth Turning – 1997

“In retrospect, the spark might seem as ominous as a financial crash, as ordinary as a national election, or as trivial as a Tea Party. The catalyst will unfold according to a basic Crisis dynamic that underlies all of these scenarios: An initial spark will trigger a chain reaction of unyielding responses and further emergencies. The core elements of these scenarios (debt, civic decay, global disorder) will matter more than the details, which the catalyst will juxtapose and connect in some unknowable way. If foreign societies are also entering a Fourth Turning, this could accelerate the chain reaction. At home and abroad, these events will reflect the tearing of the civic fabric at points of extreme vulnerability – problem areas where America will have neglected, denied, or delayed needed action.” – Strauss & Howe – The Fourth Turning – 1997

IN DECEMBER 2010 I WROTE AN ARTICLE CALLED Will 2012 Be as Critical as 1860?, THAT PONDERED WHAT MIGHT HAPPEN WITH THE 2012 presidential election and the possible scenarios that might play out based on that election. Well, 2012 has arrived and every blogger and mainstream media pundit is making their predictions for 2012. The benefit of delaying my predictions until the first week of 2012 is that I’ve been able to read the wise ponderings of Mike Shedlock, Jesse, Karl Denninger, and some other brilliant truth seeking analysts regarding what might happen during 2012. The passage above from Strauss & Howe was written fifteen years ago and captured the essence of what has happened since 2007 and what will drive all the events over the next decade. Predicting specific events is a futile human endeavour. The world is so complex and individual human beings so impulsive and driven by emotion, that the possible number of particular outcomes is almost infinite.

But, as Strauss and Howe point out, the core elements that created this Crisis and the reaction of generational cohorts to the implications of debt, civic decay and global disorder will drive all the events that will occur in 2012 and for as far as the eye can see. Linear thinkers in mega-corporations, mainstream media and Washington D.C. focus on retaining the status quo, their power and their wealth. They believe an economic recovery can be manufactured through monetary manipulation and Keynesian borrowing and spending. They are blind to the fact that history is cyclical, not linear. In order to have an understanding of what could happen in the coming year, it is essential to keep the big picture in focus. As we enter the fifth year of this twenty year Crisis period, there is absolutely no chance that 2012 will see an improvement in our economy, political atmosphere or world situation. Fourth Turnings never de-intensify. They exhaust themselves after years of chaos, conflict and turmoil. I can guarantee you that 2012 will see increased mayhem, riots, violent protests, recessions, bear markets, and a presidential election that will confound the establishment. All the episodes which will occur in 2012 will have at their core one of the three elements described by Strauss & Howe in 1997: Debt, Civic Decay, or Global Disorder.

Debt – On the Road to Serfdom

The world is awash in debt. Everyone is focused on the PIIGS with their debt to GDP ratios exceeding the Rogoff & Reinhart’s 90% point of no return. But, the supposedly fiscally responsible countries like Germany, France, U.K., and the U.S. have already breached the 90% level. Japan is off the charts, with debt exceeding 200% of GDP. These figures are just for the official government debt. If countries were required to report their debt like a corporation, their unfunded entitlement promises to future generations are four to six times more than their official government debt.

Any critical thinking person can look at the chart above and realize that creating more debt out of thin air to solve a debt problem is foolish, dangerous, and self serving to only bankers and politicians. The debt crisis took decades of terrible choices and bogus promises to produce. The world is now in the midst of a debt driven catastrophe. At best, the excessive levels of sovereign debt will slow economic growth to zero or below in 2012. At worst, interest rates will soar as counties attempt to rollover their debt and rolling defaults across Europe will plunge the continent into a depression. The largest banks in Europe are leveraged 40 to 1, therefore a 3% reduction in their capital will cause bankruptcy. Once you pass 90% debt to GDP, your fate is sealed.

Any critical thinking person can look at the chart above and realize that creating more debt out of thin air to solve a debt problem is foolish, dangerous, and self serving to only bankers and politicians. The debt crisis took decades of terrible choices and bogus promises to produce. The world is now in the midst of a debt driven catastrophe. At best, the excessive levels of sovereign debt will slow economic growth to zero or below in 2012. At worst, interest rates will soar as counties attempt to rollover their debt and rolling defaults across Europe will plunge the continent into a depression. The largest banks in Europe are leveraged 40 to 1, therefore a 3% reduction in their capital will cause bankruptcy. Once you pass 90% debt to GDP, your fate is sealed.

“Those who remain unconvinced that rising debt levels pose a risk to growth should ask themselves why, historically, levels of debt of more than 90 percent of GDP are relatively rare and those exceeding 120 percent are extremely rare. Is it because generations of politicians failed to realize that they could have kept spending without risk? Or, more likely, is it because at some point, even advanced economies hit a ceiling where the pressure of rising borrowing costs forces policy makers to increase tax rates and cut government spending, sometimes precipitously, and sometimes in conjunction with inflation and financial repression (which is also a tax)?” – Rogoff & Reinhart

The ECB doubling their balance sheet and funnelling trillions to European banks will not solve anything. The truth that no one wants to acknowledge is the standard of living for every person in Europe, the United States and Japan will decline. The choice is whether the decline happens rapidly by accepting debt default and restructuring or methodically through central bank created inflation that devours the wealth of the middle class. Debt default would result in rich bankers losing vast sums of wealth and politicians accepting the consequences of their false promises. Bankers and politicians will choose inflation. They believe they can control the levers of inflation, but they have proven to be incompetent, hubristic, and myopic. The European Union will not survive 2012 in its current form. Countries are already preparing for the dissolution. Politicians and bankers will lie and print until the day they pull the plug on the doomed Euro experiment.

The false storyline of debt being paid down in the United States continues to be propagated by the mainstream press and decried by Paul Krugman. The age of austerity storyline gets full play on a daily basis. Total credit market debt in 2000 was $27 trillion. It skyrocket to $42 trillion by 2005 as George Bush and Alan Greenspan encouraged delusional Americans to defeat terrorism by leasing SUVs and live the American dream by putting zero down on a $600,000 McMansion, financing it with a negative amortization no doc loan. Paul Krugman got his wish as a housing bubble replaced the dotcom bubble. Debt accumulation went into hyper-speed in 2006 and 2007 as Wall Street sharks conducted a fraudulent feeding frenzy by peddling their derivatives of mass destruction around the globe. By the end of 2007, total credit market debt reached $51 trillion.

In a world inhabited by sincere sane leaders, willing to level with the citizens and disposed to allow financial institutions that took world crushing risks to fail through an orderly bankruptcy process, debt would have been written off and a sharp short contraction would have occurred. The stockholders, bondholders and executives of the Wall Street banks would have taken the losses they deserved. Instead Wall Street used their undue influence, wealth and power to force their politician puppets to funnel $5 trillion to the bankers that created the crisis while dumping the debt on taxpayers and unborn generations. The Wall Street controlled Federal Reserve provided risk free funding and took toxic mortgage assets off their balance sheets. The result is total credit market debt higher today than it was at the peak of the financial crisis in March 2009.

Our leaders have done the exact opposite of what needed to be done to address this debt crisis. The country is adding $3.7 billion per day to the National Debt. With the debt at $15.2 trillion, we have now surpassed the 100% to GDP mark. The National Debt will be $16.5 trillion when the next president takes office in January 2013. Ben Bernanke has been able to keep short term interest rates near zero and the non-existent U.S. economic growth and European disaster has resulted in keeping long-term rates near record lows. Despite these historic low rates, interest on the National Debt totalled $454 billion in 2011, an all-time high. The effective interest rate was approximately 3%. If rates stay at current levels, interest will be between $400 and $500 billion in 2012. Each 1% increase in rates would cost American taxpayers an additional $150 billion. A rapid increase in rates to the 7% level would ratchet interest expense above $1 trillion and destroy the last remaining vestiges of Bernanke’s credibility. It can’t possibly happen in 2012. Right? The world has total confidence in pieces of paper being produced at a rate of $3.7 billion per day.

Confidence in Ben Bernanke, Barack Obama and the U.S. Congress is all that stands between continued stability and complete chaos. What could go wrong? Debt related issues that will likely rear their head in 2012 are as follows:

Confidence in Ben Bernanke, Barack Obama and the U.S. Congress is all that stands between continued stability and complete chaos. What could go wrong? Debt related issues that will likely rear their head in 2012 are as follows:

- A debt saturated society cannot grow. As debt servicing grows by the day, the economy losses steam. The excessive and increasing debt levels will lead to a renewed recession in 2012 as clearly detailed by ECRI, John Hussman and Hoisington Investment Management.

“Here’s what ECRI’s recession call really says: if you think this is a bad economy, you haven’t seen anything yet. And that has profound implications for both Main Street and Wall Street.” – ECRI

At present, we observe agreement across a broad ensemble of models, even restricting data to indicators available since 1950 (broader data since 1970 imply virtual certainty of recession). The uniformity of recessionary evidence we observe today has never been seen except during or just prior to other historical recessions.- John Hussman

Negative economic growth will probably be registered in the U.S. during the fourth quarter of 2011, and in subsequent quarters in 2012. Though partially caused by monetary and fiscal actions and excessive indebtedness, this contraction has been further aggravated by three current cyclical developments: a) declining productivity, b) elevated inventory investment, and c) contracting real wage income. In summary, the case for an impending recession rests not only on cyclical precursors evident in productivity, real wages, and inventory investment, but also on the disfunctionality of monetary and fiscal policy. – Van Hoisington

- The onrushing recession will send housing down for the count. With 2.2 million homes already in the foreclosure process and another 13 million homes with negative or near negative equity, the recession will push more people over the edge. As foreclosures rise a self reinforcing loop will develop. Home prices will fall as banks dump houses at lower prices, pushing millions more into a negative equity position. Home prices will fall another 5% to 10% in 2012, with a couple years to go before bottoming.

- The recession will result in companies laying off more workers. It won’t be as dramatic as 2008-2009 because companies have already shed 6 million jobs. The working age population will increase by 1.7 million, the number of people employed will go up by 1 million, but the official unemployment rate will drop to 7% as the BLS reveals that 10 million people decided to relax and leave the workforce. Surely I jest. The government manipulated unemployment rate will rise above 9%, while the real rate will surpass 25%.

- The American people rationally increased their savings rate to 6.2% in the 2nd Quarter of 2009. When you are over-indebted and the country heads into recession, spending less and saving more is a sane option. Consumer expenditures accounted for 69% of GDP in 2007, prior to the economic collapse. The “recovery” of 2010-2011 has been driven by Ben’s zero interest rate policy, the resumption of easy credit peddling by the Wall Street banks, and consumers convinced that going further into hock to attain the American dream is rational. Consumer spending as a percentage of GDP has actually risen to 71% and the savings rate has plunged to 3.6%. The 20% drop in gas prices since April bottomed in December. This decline temporarily boosted consumer spending, but prices are on the rise again. With the State and local governments reducing spending, do the Wall Street Ivy League economists really believe consumers will increase their consumption to 73% of GDP and reduce their savings rate to 1%? If you open your local newspaper you will see the master plan. Car dealers are offering 0% financing with nothing down for 60 months. The GMAC/Ditech/Ally Bank zombie lives as subprime auto loans are back. The “strong” auto sales are a debt financed illusion. Ashley Furniture is offering 0% financing for 50 months with no payments through Wells Fargo Bank. When the Federal Reserve provides the Wall Street banks with 0% funding, banks are willing to take big risks knowing that Uncle Ben and the naive American taxpayer will be there to bail them out when it blows up again.

- With recession a certainty as fiscal stimulus wears off, home prices fall, employment stagnates, and consumer spending grinds to a halt, what will happen to the stock market? The Wall Street shills paraded on CNBC and interviewed by the multi-millionaire talking head twits assure you that stocks are undervalued and the market will surely be up 10% to 15% by 2013. It’s a mortal lock, just as it has been for the last twelve years, with the S&P 500 at the same level as January 1999. The fact is the stock market drops 30% on average during a recession. The talking heads declare that corporate profits are at record levels and will continue higher. Not bloody likely. Corporate profit margins are at an all-time peak about 50% above their historical norms. Profits always revert to their mean. These profits are not sustainable as they were generated by firing millions of workers, zero interest rates for banks, fraudulent accounting by the banks, and trillions in handouts from the middle class taxpayers to corporate America.

In a true free market excess profits will draw more competitors and profits will fall due to competition. When corporate profits exceed the mean by such a large amount, you can conclude that crony capitalism has replaced the free market. Government bureaucrats have been picking the winners (Wall Street, War Industry, Big Media, Big Healthcare) and the American people are the losers. Corporate oligarchs prefer no competition so they can reap obscene risk free profits and reward themselves with king-like compensation. Mean reversion will eventually be a bitch. Real S&P earnings have reached the 2007 historic peak. To believe they will soar higher as we enter a recession takes the same kind of faith shown by Americans buying a $600,000 McMansion in Stockton with no money down in 2005. The result will be the same. Do you ever wonder how corporations are doing so well while the average American sinks further into debt, despair and poverty?

In a true free market excess profits will draw more competitors and profits will fall due to competition. When corporate profits exceed the mean by such a large amount, you can conclude that crony capitalism has replaced the free market. Government bureaucrats have been picking the winners (Wall Street, War Industry, Big Media, Big Healthcare) and the American people are the losers. Corporate oligarchs prefer no competition so they can reap obscene risk free profits and reward themselves with king-like compensation. Mean reversion will eventually be a bitch. Real S&P earnings have reached the 2007 historic peak. To believe they will soar higher as we enter a recession takes the same kind of faith shown by Americans buying a $600,000 McMansion in Stockton with no money down in 2005. The result will be the same. Do you ever wonder how corporations are doing so well while the average American sinks further into debt, despair and poverty?

The brilliant John Hussman captures the gist of an investor’s dilemma in his latest article:

“With 10-year Treasury yields below 2%, 30-year yields below 3%, corporate bond yields below 4%, and S&P 500 projected 10-year total returns below 5%, we presently have one of the worst menus of prospective return that long-term investors have ever faced. The outcome of this situation will not be surprisingly pleasant for any sustained period of time, but promises to be difficult, volatile, and unrewarding. The proper response is to accept risk in proportion to the compensation available for taking that risk. Presently, that compensation is very thin. This will change, and much better opportunities to accept risk will emerge. The key is for investors to avoid the allure of excessive short-term speculation in a market that promises – bends to its knees, stares straight into investors’ eyes, and promises – to treat them terribly over the long-term.”

The Nightmare after Christmas

by Detlev Schlichter

of The Cobden Center

Posted December 26, 2011

THE PATHETIC STATE OF THE GLOBAL FINANCIAL SYSTEM WAS AGAIN ON DISPLAY THIS WEEK. Stocks around the world go up when a major central bank pumps money into the financial system. They go down when the flow of money slows and when the intoxicating influence of the latest money injection wears off. Can anybody really take this seriously? On Tuesday, the prospect of another gigantic cash infusion from the ECB’s printing press into Europe’s banking sector, which is in large part terminally ill but institutionally protected from dying, was enough to trigger the established Pavlovian reflexes among portfolio managers and traders.

None of this has anything to do with capitalism properly understood. None of this has anything to do with efficient capital allocation, with channelling savings into productive capital, or with evaluating entrepreneurship and rewarding innovation. This is the make-believe, get-rich-quick (or, increasingly, pretend-you-are-still-rich) world of state-managed fiat-money-socialism. The free market is dead. We just pretend it is still alive.

There are, of course those who are still under the illusion that this can go on forever. Or even that what we need is some shock-and-awe Über-money injection that will finally put an end to all that unhelpful worrying about excessive debt levels and overstretched balance sheets. Let’s print ourselves a merry little recovery.

How did Mr. Bernanke, the United States’ money-printer-in-chief put it in 2002? “Under a paper-money system, a determined government can always generate higher spending…” (Italics mine.)

Well, I think governments and central banks will get even more determined in 2012. And it is going to end in a proper disaster.

Lender of all resorts

Last week in one of their articles on the euro-mess, the Wall Street Journal Europe repeated a widely shared myth about the ECB: “With Germany’s backing, the ECB has so far refused to become a lender of last resort, …” This is, of course, nonsense. Even the laziest of 2011 year-end reviews will show that the ECB is precisely that: A committed funder of states and banks. Like all other central banks, the ECB has one overriding objective: to create a constant flow of new fiat money and thus cheap credit to an overstretched banking sector and an out-of-control welfare state that can no longer be funded by the private sector. That is what the ECB’s role is. The ECB is lender of last resort, first resort, and soon every resort.

Let’s look at the facts. The ECB started 2011 with record low policy rates. In the spring it thought it appropriate to consider an exit strategy. The ECB conducted a number of moderate rate hikes that have by now all been reversed. By the beginning of 2012 the ECB’s policy rates are again where they were at the beginning of 2011, at record low levels.

So why was the springtime attempt at “rate normalization” aborted? Because of deflationary risks? Hardly. Inflation is at 3 percent and thus not only higher than at the start of the year but also above the ECB’s official target.

The reason was simply this: states and banks needed a lender of last resort. The private market had lost confidence in the ability (willingness?) of certain euro-zone governments to ever repay their massive and constantly growing debt load. Certain states were thus cut off from cheap funding. The resulting re-pricing of sovereign bonds hit the banks and made it more challenging for them to finance their excessive balance sheets with money from their usual sources, not least U.S. money market funds.

So, in true lender-of-last resort fashion, the ECB had to conduct a U-turn and put those printing presses into high gear to fund states and banks at more convenient rates. While in a free market, lending rates are the result of the bargaining between lenders and borrowers, in the state-managed fiat money system, politicians and bureaucrats define what constitutes “sustainable” and “appropriate” interest rates for states and banks. The central bank has to deliver.

The ECB has not only helped with lower rates. Its balance sheet has expanded over the year by at least €490 billion, and is thus 24% larger than at the start of the year. This does not even include this week’s cash binge. The ECB is funding ever more European banks and is accepting weaker collateral against its loans. Many of these banks would be bust by now were it not for the constant subsidy of cheap and unlimited ECB credit. If that does not define a lender of last resort, what does?

And as I pointed out recently, the ECB’s self-imposed limit of €20 billion in weekly government bond purchases (an exercise in market manipulation and subsidization of spendthrift governments but shamelessly masked as an operation to allow for smooth transmission of monetary policy) is hardly a severe restriction. It would allow the ECB to expand its balance sheet by another €1 trillion a year. (The ECB is presently keeping its bond purchases well below €20 billion per week.)

Deflation? What deflation?

It is noteworthy that there still seems to be a widespread belief that all this money-printing will not lead to higher inflation because of the offsetting deflationary forces emanating from private bank deleveraging and fiscal austerity.

Gold, Eurodollars, and the Black Swan that will devour the US Futures and Derivatives Markets

by Jesse at CaféAméricain

Posted December 3, 2011

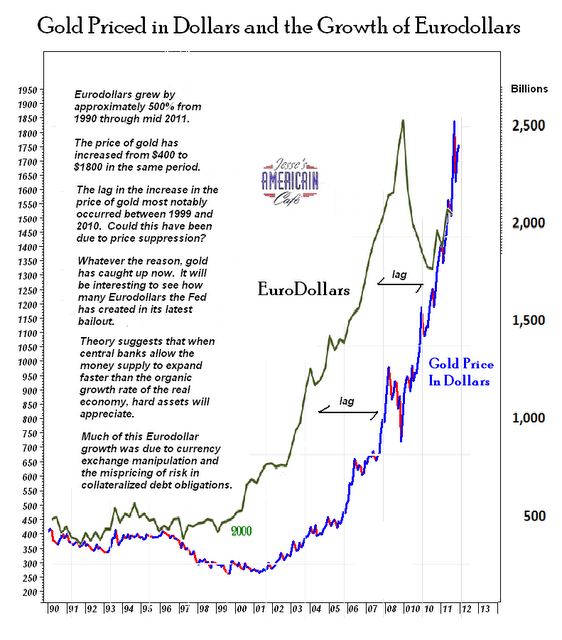

THE EURODOLLARS ESTIMATE IN THE CHART BELOW IS BASED ON THE BIS BANKING ESTIMATES from Commercial Banks and may not include official reserves held by Central Banks. As you know the Federal Reserve stopped reporting Eurodollars some years ago, with the consequence that it also stopped reporting M3 money supply. I like to think of Eurodollars and banking system derivatives as the Fed’s off-balance-sheet method of monetization and policy implementation, with plausible deniability.

THE EURODOLLARS ESTIMATE IN THE CHART BELOW IS BASED ON THE BIS BANKING ESTIMATES from Commercial Banks and may not include official reserves held by Central Banks. As you know the Federal Reserve stopped reporting Eurodollars some years ago, with the consequence that it also stopped reporting M3 money supply. I like to think of Eurodollars and banking system derivatives as the Fed’s off-balance-sheet method of monetization and policy implementation, with plausible deniability.

Swap lines are provided to other Central Banks, and they in turn make the loans to their member banks, and from there to their customers. So this eurodollar creation is made outside the real domestic economy, and therefore has no immediate effect on domestic money supply and prices at the end of the money chain. But the effect is there, and the smart money closer to the financial system sees it coming. I do not know if the Fed’s swap line activity actually shows up immediately in their Balance Sheet and therefore the Adjusted Monetary Base. But I think it is fairly obvious that if swaps are used to create dollars by foreign central banks, who in turn loan those dollars to their own members, the impact of that broader dollar creation will only be felt with a significant lag in the domestic US economy. But it will be felt at some point.

When the Fed was tracking Eurodollars, I believe that they were not counting certain assets, or liabilities from the banks point of view, as money. What exactly those assets might be and how liquid they are is a open question. How much of them were held in Agency debt, and how much in Treasury debt? Is a liquid obligation held by a foreign source part of the broad money supply, or not? Since it can be quickly converted into dollars, and then into another currency, leaves little question that it is potential money at least.

When the Fed was tracking Eurodollars, I believe that they were not counting certain assets, or liabilities from the banks point of view, as money. What exactly those assets might be and how liquid they are is a open question. How much of them were held in Agency debt, and how much in Treasury debt? Is a liquid obligation held by a foreign source part of the broad money supply, or not? Since it can be quickly converted into dollars, and then into another currency, leaves little question that it is potential money at least.

At least part of the problem being faced by Europe in this crisis is the sharp point of the deleveraging of US assets underlying dollar denominated debt. And if foreign confidence in the US dollar debt breaks, the losses would be daunting for the holders of that debt, so there will first be a rush into Treasuries and away from Agency debt and CDOs. This will be like the ocean retracting, causing people to flock to the shore in wonder at the cheapness of the debt. But eventually the returning tsunami of US dollars may very well swamp the Fed’s Balance Sheet and the domestic US economy and the savings of many. The hyper-inflation of financial paper is happening quietly and off the books. The growth rate in derivatives held by the Banks is mind boggling. And how this will manifest in the real world economy is not fully known. A good sized chunk of the financial system may simply vaporise. And I suspect that the policy makers will heavily allocate the damage to the least powerful members of the private sector.

Ownership of the real economy will continue to be concentrated in fewer and fewer hands. Stagflation is the most likely outcome because of this lack of reform and the rise of a self-serving oligarchy. As for the US Dollar, as I have said on numerous occasions, inflation and deflation are at the end of the day a policy decision. Period. Those who see a hyper-deflation or a hyper-inflation as inevitable elude my knowledge of the facts as they are. The Fed owns a printing press, and it uses it selectively.

Speaking of lags, I think the unusually long lag between the growth in Eurodollars and the price of Gold can be attributed to the gold sales programs by the Western Central Banks. Once those programs were suspended, and the Banks turned again into net buyers, the gold price rose dramatically. The most recent Eurodollar operation of the Central Banks in relieving the Dollar short squeeze in euro is not yet in the totals.

It should also be noted that there are other correlations one can use in determining the gold price, most notable ‘real interest rates.’ However, there are linkages amongst all the variables, given a non-organic increase in the money supply and artificially low interest rates for example being among them. So, when will the price of gold stop rising? Most likely when the Central Banks stop printing money, and return to transparently set market based interest rates and a productively reformed financial system. ‘Not on the horizon’ does come to mind.

Why we are totally finished

by D. Sherman Okst

Posted June 27, 2010

In a nutshell: Corporatocracy has replaced capitalism

CAPITALISM FIXES PROBLEMS AND PRESERVES DEMOCRACY: Capitalism is what we should be relying on to fix our problems. Capitalism has it’s own ecosystem, just like biology’s ecosystem. An economic ecosystem that weeds out the weak, has parasites that eat the failures and new bacteria that evolves and grows replacements for that which failed. A system that keeps everything in balance.

CAPITALISM FIXES PROBLEMS AND PRESERVES DEMOCRACY: Capitalism is what we should be relying on to fix our problems. Capitalism has it’s own ecosystem, just like biology’s ecosystem. An economic ecosystem that weeds out the weak, has parasites that eat the failures and new bacteria that evolves and grows replacements for that which failed. A system that keeps everything in balance.

The problem is we are no longer a capitalistic society. What we were taught in school is now utter and absolute nonsense. Capitalism is a thing of the past. As outlined in “It’s Not A Financial Crisis – It’s A Stupidity Crisis”, we created two back to back bubbles. The air out of the Tech Bubble was sucked up for fuel by our next stupidity crisis: The Housing Bubble.

Now, after the second Stupidity Crisis there isn’t a third bubble to inflate. If we still lived in a capitalistic environment the banks and financial institutions that created loans for folks who should have remained renters and then sold those loans as investments to pensions and countries would have been cleansed by capitalism’s ecosystem. But that isn’t what happened.

In a very anti-capitalistic move the government decided that stupidity and criminal activity should be rewarded. I’d say they took our money, but it is worse, we didn’t have that much money. So they borrowed the money in our name. The loan has a variable rate. They borrowed so much money that our kids cosigned the loan. In fact, our kid’s future kid’s signed on the dotted line.

That is unequivocally immoral. They gave that borrowed money to a bunch of morons as a reward for stupidity. Morons who created subprime loans, liar loans, no income, no documentation loans and other fraudulent instruments. Morons bundled that trash, got it rated AAA and then sold these turds or weapons of mass destruction that they had the audacity to name complex financial instruments or derivatives to pension funds, countries and other “investors”. Then it all blew up.

Big surprise. For blowing up the world’s economy this Stupidity Crisis was falsely named an Economic Crisis by CNBS and 535 morons on a hill in DC (Ron Paul and a few other fiscally responsible adults excluded). The idiots who created the mess were rewarded with a 700 billion dollar “bailout”. This “bailout” was anything but a bailout and had a price tag of anything but 700 billion. The actual price tag is closer to 11 trillion and puts us on the hook for another 13-17 trillion – not counting interest.

Think about that for a second. This stupidity crisis is the equivalent of our Federal Debt which took a generations of politicians over a hundred years to wrack-up. For anyone who still believes we live in a free country where capitalism reigns please show me one economic textbook which states that failure, and fraud get rewarded with borrowed taxpayer money. For anyone who believes we live in a democracy please show me a textbook that says the government will en-debt you and your kids and their kids to pay for a failed business. How is that democratic?

“Law of Morons”: Years ago, while serving on a committee I came to a sad realization. Like gravity, there is the another invisible force which I dubbed “The Law of Morons”. Put a group of very intelligent, well meaning people in a room together, put them on a committee or some governmental body that is devoid of guiding principles or merit-based decision making and “The Law of Morons” will prevail. The collective IQ will drop to the smallest shoe size in the room. And hope for loafers, because collectively this body won’t be able to tie anything together – not even a single shoelace.

Government Creates Problems: Basically our government is comprised of many well meaning intelligent people who for whatever reason, re-election, greed the “Law of Morons”, corporate puppet strings (read: lobbyist), self interest, corporatocracy or whatever else, do nothing but create massive problems. Lack of regulation, too much regulation.